Meet the Financial Minds Behind maraventhilosqa

We're not your typical financial advisors. Our team combines decades of real-world experience with a genuine passion for helping people make sense of their money. Each of us brings something different to the table, but we all share one belief: smart budgeting shouldn't feel overwhelming.

The People Driving Your Success

Behind every financial decision you make with maraventhilosqa, there's a real person who's walked a similar path. We've been corporate executives, small business owners, and yes — we've made our share of money mistakes too.

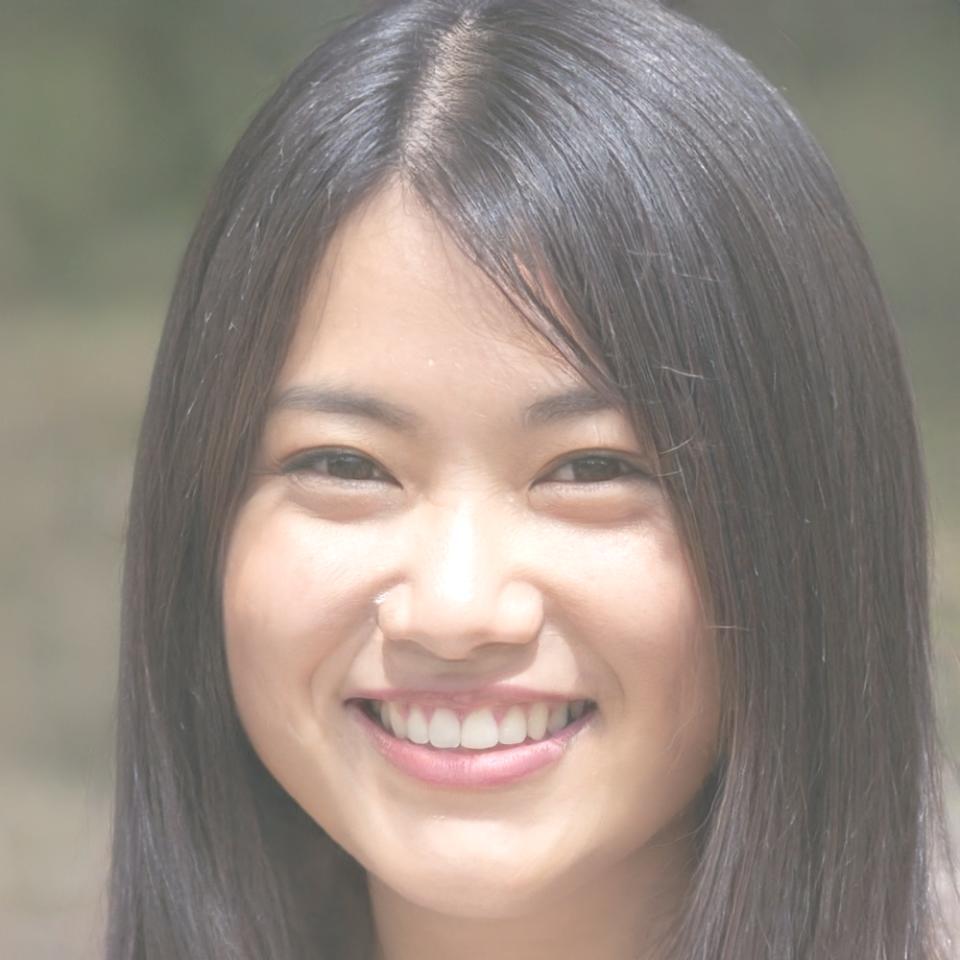

Sarah Chen

Lead Financial Strategist

Sarah spent 12 years as an investment banker before realizing she was helping make the rich richer while regular people struggled with basic budgeting. In 2022, she joined maraventhilosqa to bridge that gap. She's particularly passionate about helping families navigate major financial transitions — buying homes, starting businesses, or planning for retirement. Sarah's approach combines rigorous analysis with practical, real-world advice that actually works for busy lives.

Marcus Rodriguez

Budget Analysis Director

Marcus is a CPA who built his career helping small businesses survive their first five years — the make-or-break period when cash flow can determine everything. He's seen every budgeting mistake in the book and developed systems that prevent them. What sets Marcus apart is his ability to take complex financial concepts and translate them into simple, actionable steps. He joined maraventhilosqa in early 2024 because he believes everyone deserves access to the kind of financial guidance that was once only available to wealthy clients.

Our Extended Team

Specialists & Partners

Beyond our core leadership, we work with a network of certified financial planners, tax specialists, and industry experts across Canada. This collaborative approach means you're never limited to just one perspective. Whether you need help with mortgage planning, business incorporation, or understanding new tax legislation, someone on our extended team has the specific expertise you need. We believe in bringing the right expert to your unique situation, not forcing one-size-fits-all solutions.

What Drives Everything We Do

Real Experience Over Theory

Every piece of advice we give comes from actual experience — either our own or lessons learned from working with thousands of clients. We don't just read about financial planning; we've lived through market crashes, economic uncertainty, and personal financial challenges. That real-world perspective shapes everything we recommend.

Solutions That Fit Your Life

Cookie-cutter financial advice doesn't work because no two lives are identical. A single parent in Toronto has different priorities than a retired couple in Vancouver. We take the time to understand your specific situation, goals, and constraints before recommending anything. Your financial plan should work with your life, not against it.

Transparency in Everything

We believe you should understand not just what to do with your money, but why. Every recommendation comes with clear explanations, potential risks, and alternatives. There are no hidden fees, no confusing jargon, and no pressure to make quick decisions. When it comes to your financial future, informed choices are always better than blind trust.

Long-term Thinking

Quick fixes rarely create lasting financial stability. We focus on building systems and habits that serve you for decades, not just the next few months. This means sometimes recommending the less exciting but more sustainable option. Our success is measured by your long-term financial health, not short-term gains that might backfire later.

Why We Started maraventhilosqa in 2019

The financial industry had a problem: great advice was expensive and generic advice was everywhere. We saw people making costly mistakes simply because they couldn't access the kind of personalized guidance that wealthy clients take for granted. maraventhilosqa was our answer — a platform that combines sophisticated financial analysis with genuine human insight, made accessible to everyone who's serious about improving their financial situation.

Start Your Financial Journey